How to Manage and Track Grants for Your Nonprofit

Many nonprofits view the first few months of the year as the best time to go grant shopping, and if you’re wondering where to go to find grants, you can check out Grantstation. But while you’re thinking about finding the right grant, you also need to consider how you’ll manage and track your grants when you eventually receive them.

Many grants come with restrictions, and in this article, we’ll talk about what it means for grants to be restricted, why it is essential to track them, and how you can track them. You can watch the video explainer of this article here.

Learn How to Develop an Effective Grant Management Strategy for your Nonprofit

Watch this free on-demand webinar to learn the best practices for managing, tracking, and reporting on grants and

What is a Restricted Grant

A restricted grant is a grant with strings attached to it. This means that there are conditions within which the grants must be used.

There are two types of restrictions for grants:

- Use Restrictions: You have to spend the grant in a specific manner or for a particular purpose. In this case, the grant funder restricts how you can spend the grant. E.g., you’re told to spend the grant on only the rental expenses involved in a specific program.

- Time Restrictions: You have to spend the grant over a specific period. In this case, the grant funder restricts how long your spending on program activities can last.

Restrictions exist because many funders want to keep tabs on how their grants are being spent and the impact the grants are making. In most cases, nonprofits that receive restricted grants will need to submit a report on how the grants were spent.

It is challenging to pull together all the details for your grant report if you haven’t been tracking them all along. You may not be the accounting personnel on your team, but whoever is managing your expenses should be pointing your transactions to grants. This will make it easier for you to create a report when it’s due.

How to Track Restricted Grants

1. Use your accounting software package

No matter what you do, don’t track your grants in an excel spreadsheet no matter what you do. If it’s in an excel spreadsheet, no one can validate the accuracy of your numbers. But with a nonprofit accounting software package like QuickBooks or Xero, you can more accurately calculate and measure your grant spending over time.

To do this:

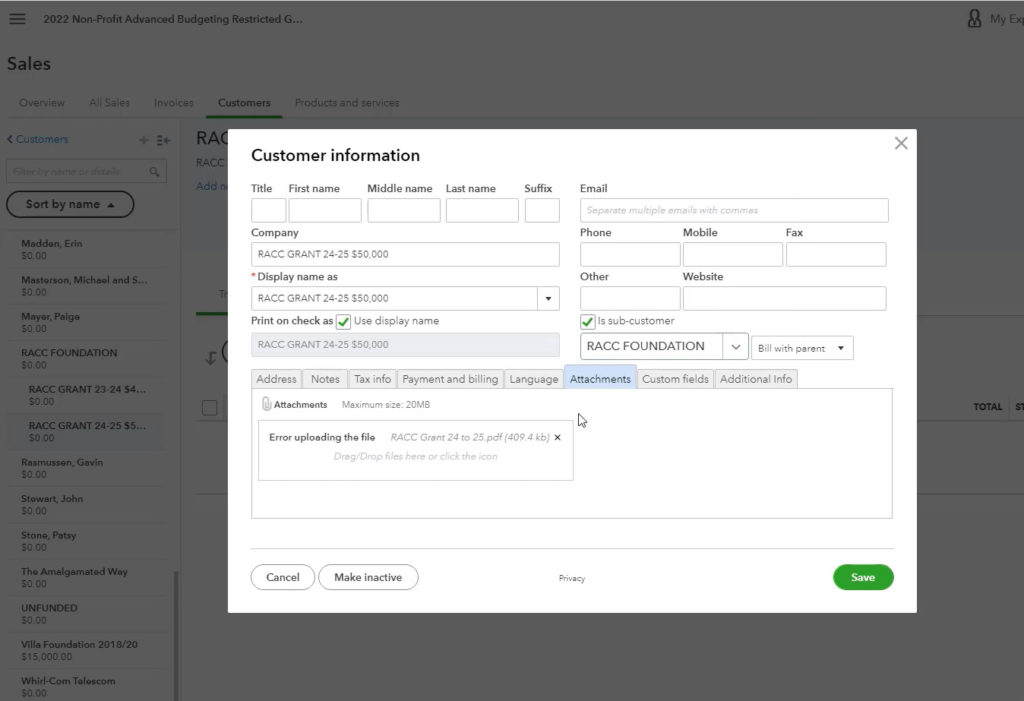

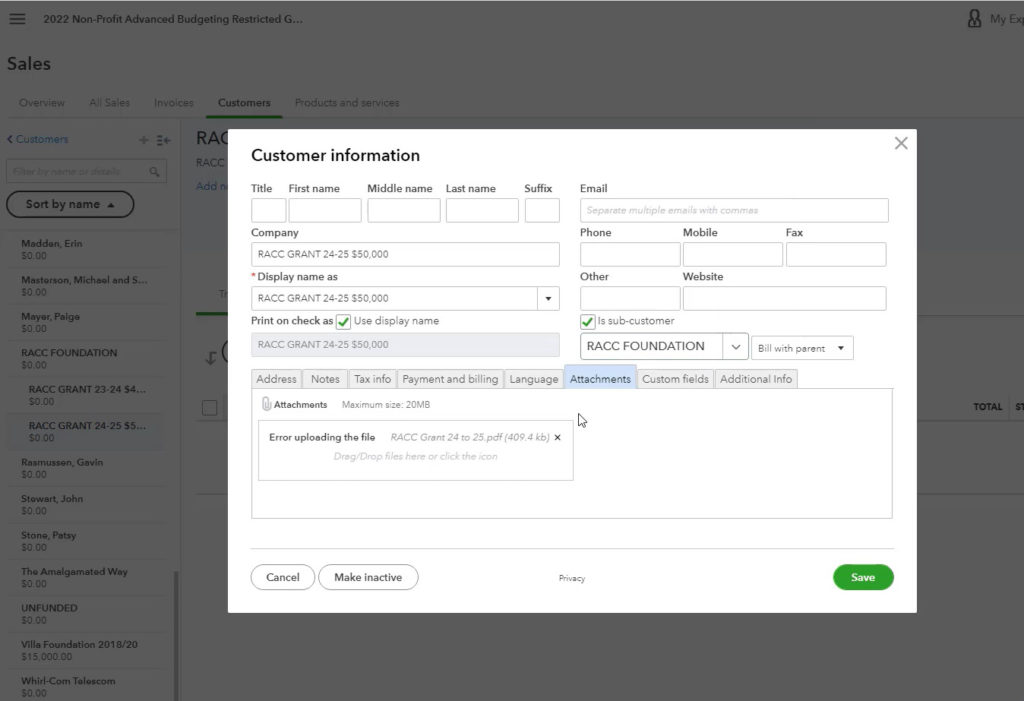

- Set up each grant as a customer in your accounting package.

- Track each grant from the same funder separately, even if you receive the grant every year. This will make it easier to track the grant or transaction that an expense was paid out of.

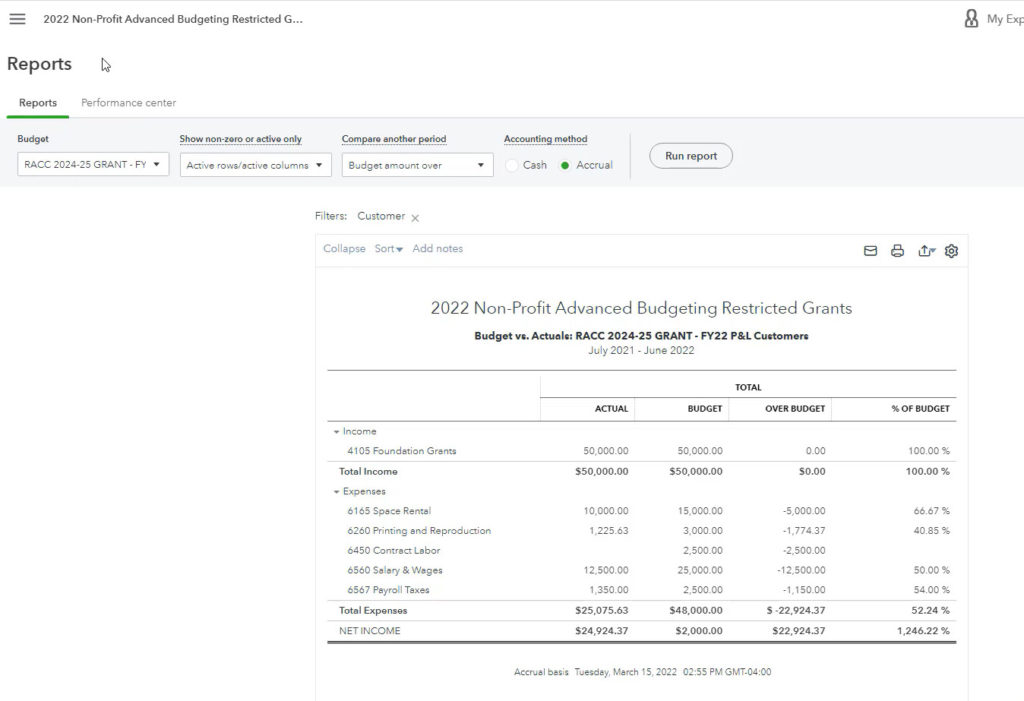

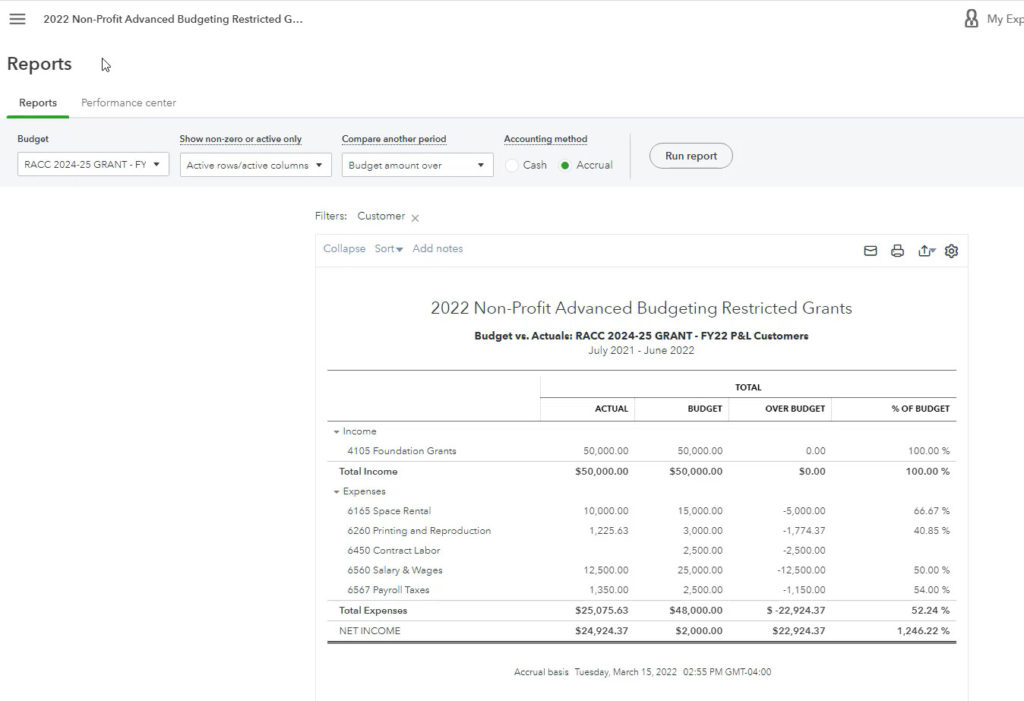

- Point your expenses to grants as you enter each transaction. This is vital for tracking your restricted grants. Most importantly, if your nonprofit receives a grant with a preapproved budget, you can easily enter your budget in your nonprofit accounting software package and later pull a comprehensive report like the one shown below, which displays actual and budgeted spending.

- Save Your Grants. When you get your signed grant, save it in a folder and attach it to the customer (named after the grant or grant funder) in a nonprofit accounting software package like QuickBooks. The benefit of doing this is that when you’re auditing and reviewing your financial records and performance, you can see your grants easily and factor them into your assessment.

2. Set up calendar reminders for when grant reports are due

More than one person on your nonprofit team must know when your grant report is due. So make sure the calendar reminders for your grant report are shared publicly with your team. If the person responsible for reporting on your grant exits your nonprofit or is absent from work, someone else on your team should be able easily to pick up this task and make sure it gets done.

So, you’ve won (or lost) your grant. Now what?

This Free Grant Stewardship Checklist will guide you through the next steps to take after you’ve been approved for a grant (or not). It also includes tips and resources to make your next application even better.

As essential as it is for nonprofits to seek and receive grants, organizations must ensure they have a plan in place for managing and tracking these grants. The best way to do this is by tracking them in your nonprofit accounting software package, not an excel spreadsheet. If you want to learn more about using QuickBooks to manage and track your nonprofit’s grants, visit quickbooksmadeeasy.com

About the author:

Gregg S. Bossen, CPA, Founder of QuickBooks Made Easy for Nonprofits

Gregg, an Advanced Certified QuickBooks® ProAdvisor, is a practicing CPA with a full-service accounting firm located in Atlanta, Georgia. He is also the president of QuickBooks® Made Easy™, a company specializing in QuickBooks® training through live seminars, webinars, training products, and one-on-one consulting.